6 Easy Facts About Shutting Procedure For Mortgages Explained

transfers ownership of your brand-new home from the vendor to you. Yes, there's a lot taking place, as well as a whole lot of cash is going to transform hands. However when you recognize what to expect as well as intend well, it can be a smooth, fairly low-stress experience.

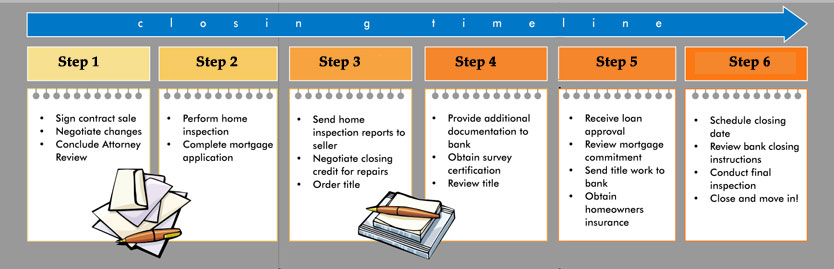

The house closing procedure actually starts as soon as you as well as the seller have actually authorized an acquisition agreement. People frequently describe this period as being "in escrow." What's the evernote.com/shard/s418/sh/d2db9b3a-8bd2-43b9-96d2-77b5c515970c/48cd043cf01124d63b6ef54b858f96dd timeline? Typically 4 to 6 weeks. In tight markets, however, it can be as long as 2 months, because it's harder for sellers to collaborate the sale of their residence with getting another.

Closing on a house is a huge bargain, yet it may really be simpler than finding one that you desire as well as can manage in the very first area. As well as when it mores than, you leave with the keys! And a home loan. To seal the deal on your residence, you need a closing agent (also called a settlement or escrow representative).

In many states, the closing agent is a neutral third event who helps a negotiation company (often called an escrow company or title firm). Often you can choose the firm; this is frequently bargained with the seller. The standard Lending Quote create you received after you got your finance notes the closing services you can buy (see page 2, area C).

The 6-Minute Rule for Shutting Procedure For Mortgages

Yet others need one to prepare just specific records, so you wind up with both a settlement company and a property attorney. Which states require an attorney for all or part of the process? We hesitate to offer you a list, considering that regulations alter at all times. A lot of them are east of the Mississippi.

Where a lawyer is optional, you could desire one anyway. Unless you employ your very own lawyer, there's no person at the closing who exclusively represents your lawful rate of interests. If there's anything unusual concerning the sale, certainly play it secure and work with one. Even the very best real estate agent is not an actual estate lawyer.

Your state bar organization might have a lookup. Per hour fees typically run from $150 to $350. Lenders need you to acquire house owners insurance coverage and bring the plan to the closing. That coverage is rather important to both you and them! As you can imagine, the expense of insurance coverage differs widely depending on the worth of your home, just how beneficial your things is, and also where you live.

Prior to you go shopping, take a look at these eight common false impressions regarding homeowners insurance policy. When you purchase a house, you're getting the "title" to the property, which offers you sole, clear possession. Title insurance policy offers protection in the unlikely yet possibly devasting event that another person, one day, makes a shock insurance claim on the building.

Steps In Closing A Mortgage Fundamentals Explained

The vital thing to understand is that you need your own policy. Your loan provider will certainly need you to get title insurance to shield their financial investment, but their policy does not cover you. Technically, it's optional for you, but please do not pass on it. Without it, you might shed your home as well as your whole financial investment if your title ever before were challenged.

The price of a title insurance plan varies commonly around the nation. The average is regarding $1,000. You can conserve money by getting both policies from the very same business. Generally, the lender has a recommended insurer, yet you deserve to pick a various one. Prior to you can close, you need to fulfill all the problems established by your loan provider.

Some conditions can be details to your financing, but common ones include a clear title record, an appraisal number that goes to the very least the amount of the loan, paperwork of your income, and also evidence of insurance. If you end up being worried regarding satisfying any of the conditions, call your loan policeman ASAP.

Do on your own a favor as well as begin your organizing, packing, and various other tasks early. You'll have enough on your mind on closing day without stressing over finding even more boxes. Below's a sanity-saving eight-week checklist for you. This important paper, a nationally standard kind, itemizes the closing sets you back to both you and the vendor and also describes crucial details regarding your funding.

An Unbiased View of Closing Procedure For Home Mortgages

The expenses shown in the Closing Disclosure should be similar to what you saw on the Loan Estimate back when you got the car loan. Any type of surprises? Begin asking concerns. The walk-through is a quick last consider your soon-to-be residence. Your representative will arrange it, ideally for the exact same day you close.

The walk-through might be quick, yet it isn't simply a rule. Prior to you take ownership of the residential property, you require to make certain the seller truly has actually moved out and also left things in the condition you accepted. Every agent has stories: vendors that have not also started packing, a shattered picture home window ... If anything is amiss, your representative will certainly get on the phone promptly.

If the seller was meant to do anything major, have actually the work checked by a professional before the walk-through. The closing representative (whether that's a settlement firm or your lawyer) will send you a checklist of everything you need to give the closing. If you have any type of questions, do not wait to contact the closing representative or your loan provider.

The mortgage as well as various other records are signed, settlements are traded, and also finally, the waiting mores than: you get the secrets. If you have any kind of unanswered questions, this is your last opportunity. You'll be dealing with a quite big heap of documentation. It's not so negative if you understand what's coming, so here's a brief guide to your closing documents.

Things about Steps In Closing A Home Loan

If your closing representative is your own attorney, it will probably go to their office. Who will exist? This varies depending upon where you live. Your real estate representative can tell you what to expect. Often there's a real group, consisting of the closing representative from the settlement company, your lawyer if you have one, the seller's attorney if they have one, the lender's agent, the vendor, and also both actual estate agents.

You might have the secrets, yet you're not done yet. After you close, it's smart to file a homestead statement, additionally called a homestead exemption. In some states, homestead is automatic, yet don't presume. Ask your genuine estate representative or closing representative concerning it. A homestead declaration registers your house with both the government and state federal governments as your primary residence and also secures it in various methods.

The details can be a bit challenging, but homestead normally obtains you at least three type of protection: If you ever face personal bankruptcy, homestead can assist avoid the forced sale of your house to pay financial debts, other than for the home mortgage (i.e. no help in a foreclosure circumstance), building and construction liens, and also real estate tax Spares you from a certain amount of real estate tax Helps a surviving spouse keep in the residence To file, contact your region assessor's workplace.