See This Report about Advise From Financial Experts

A simple guide: I started my career as a stockbroker (my card said "financial advisor") at one of the biggest Wall Street brokerage companies. I can't count how many times clients and potential customers asked me, "How do monetary consultants make money?" It's a perpetual source of confusion. At the threat of putting them to sleep, I would a minimum of attempt to describe our 21-page Financial Consultant Compensation Strategy.

My customers trusted me and that was the most essential thing to me. https://www.washingtonpost.com/newssearch/?query=financial advice Nevertheless, I likewise thought my long-story description wasn't making sense to them and they were constantly a little doubtful of the firm. The monetary universe has gotten just more complex given that then, so misunderstandings over how brokers make money persist.

Commissions: When a broker whose dealing with commission basis suggests a particular fund, annuity or any other investment item, there's a sales charge that comes right out of your pocket (a sales load, which can run 3-6% of your financial investment straight off the top). Or in some cases the business whose product he or she is recommending pays the broker's commission as a 'marketing expense' for that business.

In either case, commissions produce a conflict of interest for the advisor. Why? This broker or consultant has a big reward to recommend http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/financial advice the option that pays him/her the most whether those financial investments are really best for you, the client. Incentives are fine but we're discussing financial investments, not hamburgers or utilized vehicles.

The Buzz on Advise From Financial Experts

This is why if you do utilize a commission-based monetary advisor, you'll desire employ one that is legally bound to put your interests first, above their own. This is called a financial investment Ok so how do I escape this Wall Street driven sales culture and get a fair deal? Fee-Only: By far the most touted by the media and talking heads (like me) is the fee-only design.

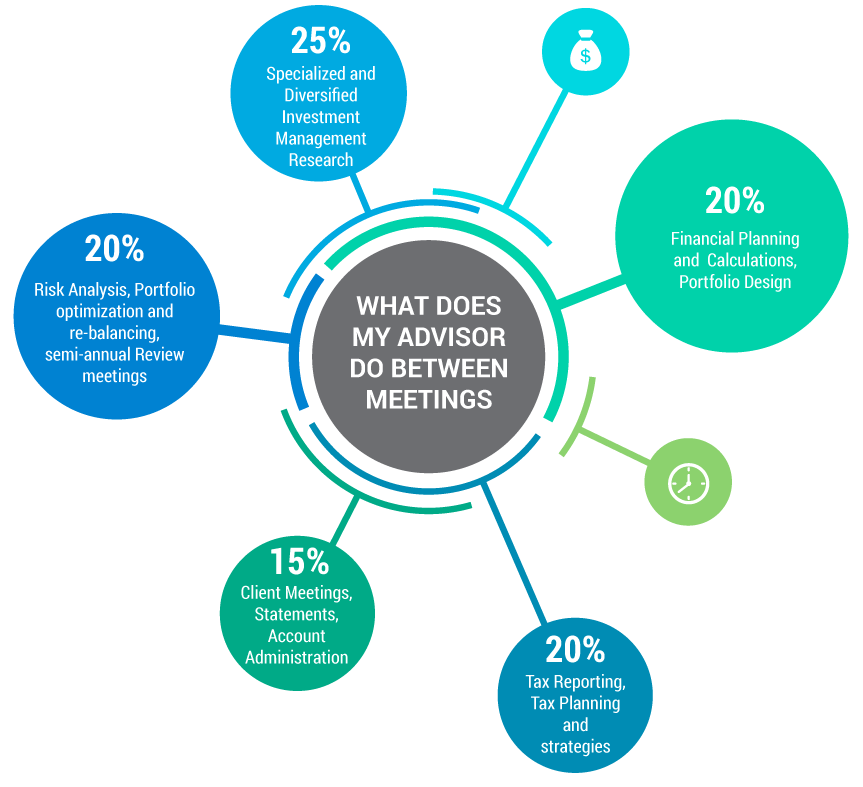

To hold yourself out as a fee-only consultant, you can not likewise offer life insurance coverage, annuities or any other investment for commission. Fee-only consultants work for their customers and ONLY earn Home page money a hourly rate, a set yearly retainer or a portion of the investment possessions they handle for their customers.

Charge varieties are all over the map, but usually typical somewhere between 1-2% of the total worth of the financial investments being handled. Say you have a $500,000 portfolio that you handle with the aid of a fee-based (that is, asset-based) consultant charging 1% of your portfolio's worth each year. In that case, you're paying $5,000 a year for that guidance.

If the portfolio is closely simulating the total market it might not be worth http://dorisquinlan348d.theburnward.com/financial-advisor-duties-a-helpful-overview paying a manager even 1%. But if this consultant creates steady, affordable returns regardless of the marketplace gyrations and keeps you from going off the rails whenever there's market drama, or taking excessive threat unconsciously, then a charge of approximately 1.5% may be well deserved.

Getting My Financial Advisor Duties To Work

Fee-Based: Fee-based advisors blend the commission-only and fee-only models. They can offer you a financial investment and get a commission from that deal, or they may charge you a charge computed as a portion of properties to handle your portfolio, or they may do both. While the term "fee-based" may sound really comparable to "fee-only," there are crucial differences.

I know great deals of really certified advisors who are primarily fee-based (most of their incomes come from fees), but they can provide you a mutual fund or an investment that generally features a commission. For instance, a consultant may really believe highly in a fund household that has a sales commission or 'load' integrated in, however I have actually even seen cases where the consultant will ensure that expense does not come out of your pocket.

I constantly say, from my days as a Continue reading broker, the thicker the paperwork that explains an advisor's compensation, the more you'll pay for that suggestions. Pam Krueger is the creator of Wealth Ramp, co-host of Cash Track on Personal Injury Attorney PBS and national spokesperson for The Institute for the Fiduciary Standard.

To be a better Website link monetary advisor, you require to do more than handle money. You require to be great at managing relationships. While the cash part is crucial, it's individuals part that matters most. Relationships are the lifeblood of a reliable investment advisory practice. Being excellent with people is what transforms prospects to customers and makes clients feel comfortable adequate to refer their pals, household, and coworkers to you.

The smart Trick of Financial Advisor Duties That Nobody is Discussing

As an investment advisor, you ought to be familiar with the "Know Your Client" guideline, developed to protect against money laundering and to make sure https://en.wikipedia.org/wiki/?search=financial advice the viability of investments. While this guideline only needs you to confirm and keep some pretty standard client info, it can be seen as Personal Injury Case a call to action.

If you haven't done so currently, get in touch with your customers and recommendation partners on social media networks. When you link on social media, you'll have a window into their lives and be welcomed to their everyday conversations. The more you know people, the much better you'll be able to serve them.

However often that's the very first place to begin! Be a better monetary advisor by going above and beyond with your network. Having your clients and potential customers in your address book or on your good friends' list is simply the start. For your clients, it is essential that they hear from you regularly.

They also wish to know that you appreciate what's going on in their lives. When it comes to your prospects, make certain you remain at financial advice aged care the top of their factor to consider set. Not everyone is in the marketplace for your services today, but eventually a number of them will be. When that minute occurs, you desire them to think about you first.

The Ultimate Guide To Financial Advisors

Automated marketing services, like Outbound Engine, make it easy for financial advisors barbaradriscolltillmancjwx678.nikehyperchasesp.com/selecting-swift-methods-in-personal-injury-attorney to remain in touch with their networks without requiring hours a day on social networks marketing. Specifying your consumer is the first rule in company. Yet couple of monetary advisors ever make the effort to establish a crucial target audience.

That's not the type of info one tends to broadcast to the world. Concentrating on a particular client specific niche, like tech industry founders or alumni of your university, can have many benefits for your practice. It makes it easier to discover and get in touch with potential customers. You can tailor your marketing message to the specific requirements of your target market.

BENEFIT: Serving customers in a specific niche can produce more referrals. People in the tech industry know other techies, and alumni enjoy to help their fellow alumni. Break concepts down as much as possible to be certain that all celebrations understand the problem or process at hand. To be a much better monetary advisor, your clients ought to comprehend the investment technique you are recommending and feel on track to achieve their objectives.

While your clients desire to feel great that you know your stuff, they require to comprehend what you're recommending and how it's going to help them prosper. Make it easy for them by being clear and direct. Money develops anxiety for lots of people. Even clients you've had for years may feel a bit concerned discussing financial resources sometimes.